Contributed by: Krish Ajmera – Grade 11 Commerce student

Do you know even if you earn money and keep it in a safe, you will be eventually losing it?

How is that possible? The reason is Inflation.

Let us understand it with an example:

Assuming you make INR 50,000 monthly, you keep INR 5000 aside as savings. By the year-end, you would have INR 60000 in your savings account. Saving 5000 monthly can lead to 60000 at the end of the year.

WOW!! HAPPY?

Well, you shouldn’t be. Why? That’s because inflation in India in 2021 was at around 5.59%. Now, what does that mean and how does it affect you?

Inflation is the rate at which the value of a currency is falling and, consequently, the general level of prices for goods and services is rising.

Let us assume that in 2020 you were able to buy 10 apples with INR 100. With inflation in play at around 5 %, you would be able to buy only 6.67 apples with INR 100 {because now each apple will cost INR 15 instead of 10}

Cost Price Index

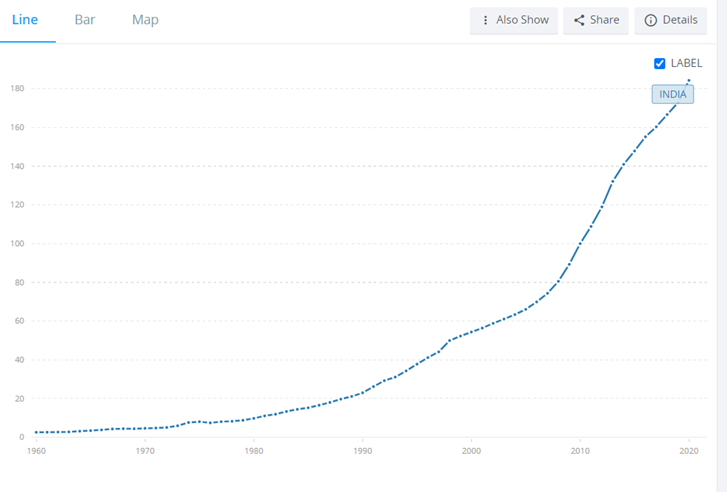

Let us understand this better with the help of the consumer price index (CPI) maintained by the World Bank.

The Consumer Price Index (CPI) is a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care. It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them.

The CPI for India in 2022 is 184 (the base year 2010 = 100), which means that INR 184 in 2022 has the same buying power as INR 100 in 2010. That’s the reason why saving money is not enough because as time passes by, its purchasing power depreciates. That means if you had saved INR 100 in 2010, it would make you lose INR 84 by 2021 because of the depreciating purchasing power of INR.

Investing

So, what is a better alternative to saving? It is Investing.

Investing is the act of allocating resources, usually money, with the expectation of generating an income or profit. There are numerous investment opportunities a person can invest in and earn a return on investment of 5-10% annually.

Some of the investment opportunities are:

- Real estate

- Equities

- Government bonds

- Commodities

- Bank Fixed deposits

- Gold

According to risk appetite and expected returns, one can invest accordingly using the above-mentioned investment tools. For example, if one wants to invest with minimum risk, the person can invest in Bank Fixed deposits or Government bonds. One looking for making huge profits by taking risks at an early age can invest in the equities of a company i.e. buying shares of that company.

Stock Market

Over the past few years, Indian stock markets have witnessed massive wealth creation. Today, many ace investors like Mr Rakesh Jhunjhunwala and Mr Vijay Kedia have made a billion-dollar fortune in the stock market.

Is it possible for ordinary people like us to make reasonable returns from stock markets?

Yes, of course. Anyone can learn the tricks of trading and investment in stock markets.

Are stock markets gambling dens??

Many people believe that stock markets are nothing but gambling dens. I feel it’s true for people who invest/trade without any education, research or analysis.

A key principle in gambling and investing, is to minimize risk while maximizing profits. Gamblers have fewer ways to mitigate losses than investors do. Investors have more sources of relevant information than gamblers do. Eventually, the odds will always be in favour of an investor and not of a gambler.

What are stock markets exactly?

Considering the current scenario, growing environmental concern and the gradual move from fuel-powered cars to electric cars will immensely benefit electric-vehicle manufacturers.

Seeing rising inflation rates, you decide to invest in electric vehicle companies. Now, how do you do that? Do you buy the company worth probably 100s of crores? NO.

What you can do is buy parts(equities) of that company. Is that possible? Yes. That’s the exact purpose of stock markets. Stock Markets have 1000s of companies listed which want to raise funds in exchange shares (small parts of the company).

Now let’s assume that you want to invest in Tata Motors, an electric vehicle manufacturer. You buy equities/shares of Tata Motors from the stock exchange (BSE/NSE). The last traded price of Tata motors was 459.75. It means by paying 459.75/- you can buy one share of Tata Motors that will make you a partial owner of the company (you will own 0.0000010966 % of the company).

The prices of stocks increase or decrease based on demand and supply. Hence, it is imperative to stay updated with the economic changes.

Skills required for stock markets:

- Analytical skills

- Research skills

- Control over emotions (ability to stay calm)

- Record maintenance (bookkeeping)

- Patience and discipline

I feel the most important skill is having control over emotions. It is essential to understand that it is difficult for a professional trader or investor to time the market with 100% precision. One is bound to make a few mistakes while trading in the market. So, one should accept losses gracefully and learn from their mistakes.

Recently many colleges and the stock exchanges have started providing academic and practical courses to students and professionals on stock markets. A few programs that can help students gain expertise in the financial domain are:

- BFM (Bachelors of Financial Markets)

- NSE provides programs on various topics (trading, fundamental analysis, options trading)

- CFA – Chartered Financial Analyst (It is an American professional course related to financial education and investments)

To sum it up, in these times of rising inflation rates saving is not enough, so you need to start investing. But you should not invest without prior education, research and analysis as then it will be no different from gambling.